by Peter Neuwirth, FSA, FCA; Barry H. Sacks, J.D., Ph.D.; and Stephen R. Sacks, Ph.D.

This paper examines the effect of using reverse mortgage credit lines to supplement retirement income by two types of retirees that have not been addressed in the previous literature: (1) those whose retirement savings are significantly below those of the mass affluent; and (2) those who are “house rich/cash poor.”

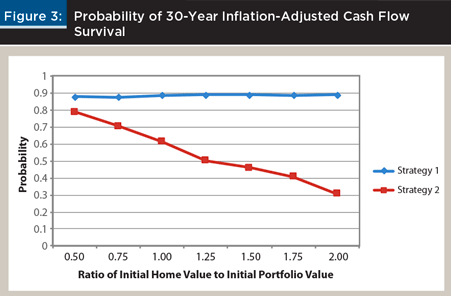

Results of this analysis demonstrate an important contrast with the results of the earlier literature; specifically, the greater percentages of home value, when coordinated with the retirement savings portfolio, resulted in substantially greater percentages of the portfolio that can be drawn.

This paper suggests a new alternative to the 4 percent rule that can guide planners and retirees toward an optimal cash withdrawal strategy. This new rule takes into account the total of the retiree’s retirement savings plus his or her home value.

The quantitative analysis in this paper uses the same spreadsheet models and strategies first presented in the Journal by Sacks and Sacks (2012). This paper builds on that work by extending the analysis to a broader range of retirees.

Full paper here